@mrjackson

Profiling, wealth overview, financial planning, wealth allocation by major asset class

UCITS, live securities, structured products

Private debt

Structuring, transmission, conflict prevention, international taxation

Loans: Mortgage, Lombard

Local and international partners

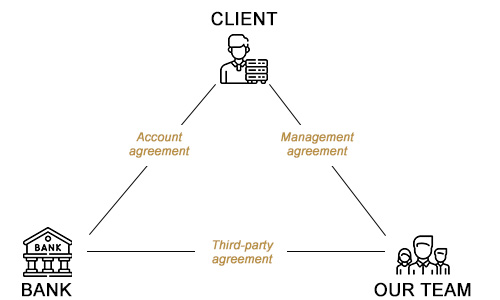

We boast multiple partnerships with renowned financial institutions, allowing us to open and manage accounts with prestigious private banks, on behalf of our clients.

We determine the relevant management agreement to adopt, based on our clients’ needs and expectations.

Signature of the appropriate management agreement.

Necker Finance is allowed to issue payment orders on behalf of its clients, across various markets.

We determine the type of account.

Opening of the account with one of the partner banks.

The selected bank manages the account, holds the securities and executes the instructions deployed by the manager.

The manager becomes a middleman between the client and the bank.

Regular face-to-face meetings to conduct reviews, establish economic outlook and determine market opportunities.

Investors make their own decisions following their manager’s advice and recommendations.

Investors delegate the management of their portfolio, allowing managers to make relevant decisions based on investors’ objectives and in line with their agreement.

Portfolio management is adapted to the investor’s risk aversion.

RISK

PORTFOLIO TYPES

Comprises a minimum of 90% fixed income investments (cash, bonds, money market funds, alternative products) and a maximum of 10% equities.

Comprises a minimum of 65% fixed income investments and a maximum of 35% equities.

Comprises a minimum of 40% fixed income investments and a maximum of 60% equities.

Freely managed, without constraints. Investment opportunity: 100% in equities.